Declare sports bets

The tax declaration campaign begins on April 1st, and as bookmakers users, we must be clear on when and how to declare online betting winnings since they do not appear in our tax data yet. This is because, at the moment, Hacienda has not obliged game operators to report income on their tax models, but it has access to the information if requested. Be careful with this!

For many users of sports betting and online gaming in general, it is becoming quite complicated to decipher how to declare their winnings and where their obligations lie. In Philippines, as in many countries, ignorance of the law does not exempt you from compliance, so we must be well informed about how to act in case of winning in online gaming.

Table of contents

- 1 Declare sports betting

- 2 Are we required to declare our earnings in the income statement?

- 3 What exactly am I required to declare?

- 4 When do you have to declare sports bets?

- 5 I play in different betting houses, how do I declare it?

- 6 How much tax is paid for sports betting?

- 7 Do I have to declare winnings even if I don't withdraw the money from the bookmaker?

- 8 Do the bonds affect me when making the income statement?

- 9 Frequently asked questions about declaring sports bets

We recommend that in case of doubt, we have at our disposal a helpline provided by the Tax Agency (901 335 533 or 91 554 87 70) and we can even request a prior appointment at our nearest branch, provided that we do not exceed the established limits. They will help Philippines to correctly file our declaration. Another option is to consult a specialized professional advisor.

Are we required to declare our earnings in the income statement?

There is a minimum amount for which we have to declare, depending on whether we have other incomes. Thus, we are obligated to declare:

- If you obtain a profit from online games or other property income or movable capital income exceeding 1600 dollars.

- If you obtain any benefit or loss from the game and also have work income exceeding 22,000 dollars, or real estate incomes, treasury bill returns or a subsidy for publicly protected housing exceeding 1,000 dollars.

Practical examples

- I have a job where I earn 15,000 dollars annually and this year I have made a profit of 1500 dollars from online gambling, am I obligated to declare it? NO.

- I have a job where I earn 25,000 dollars annually and this year I received 900 dollars from sports betting profit. Am I required to declare it? YES, you are required to declare both the earnings from your job and the gains obtained from sports betting profit.

- I have a job where I earn 18,000 dollars annually and this year I have obtained 1900 dollars in profit from poker, am I obligated to declare it?YES.

What exactly am I required to declare?

Many of Philippines still get confused about what we have to consider to calculate the profit we have obtained over a year

Balance as of December 31 - Balance as of January 1 - Income + Withdrawals

Example: if I deposited 100 dollars in 2019, at the end of the year I had 4,500$, at the beginning of the year I had 1,500 dollars and I withdrew a total of 1,000$, my net profit is 3,900 dollars (I have to subtract the initial 100 dollars I deposited) and this would be the amount for which I am obligated to declare.

4,500$ - 1,500$ - 100$ + 1,000$ = 3,900$

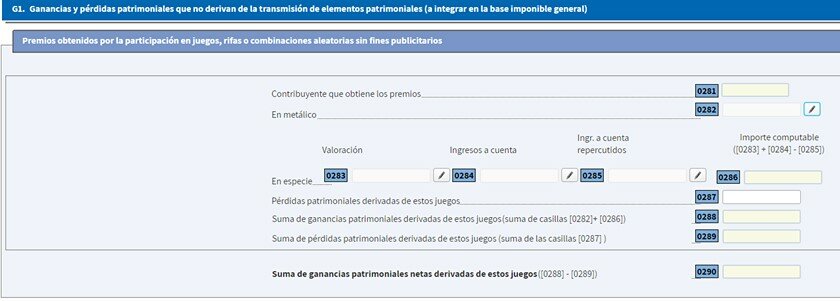

As usual, on the Hacienda help phone, they insist that we need to reflect gains on one side and losses on the other. Boxes 282 and 287 of the income tax return. The final result will be the difference between both amounts, box 290. Moreover, if only gains exceed $1,600, even if we have greater losses, we must reflect it in the declaration, since we would already be required to file the return.

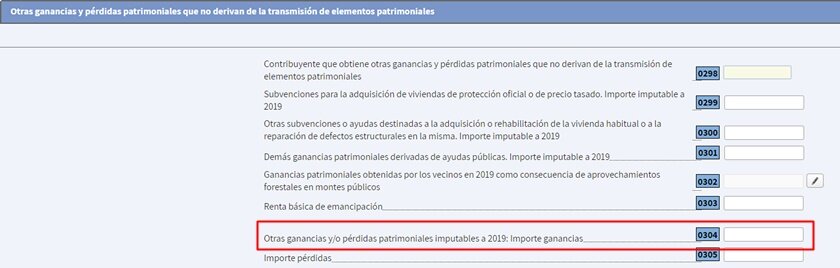

Now, what happens if I don't have my gains and losses from the year? Most betting companies include sufficient data in their annual report to apply the Balance at December 31 - Balance at January 1 - Deposits + Withdrawals rule, making it more difficult for Philippines to know the gains and losses for the whole year and reflect them as previously explained. Therefore, another option to include it in the income tax return is to enter the net profit data in box 304 (other capital gains and/or losses).

When do you have to declare sports bets?

Taking into account what we have just seen, we can find ourselves in up to two situations in which we have to declare our profits in sports betting. In the first case, when we have obtained profits over $1,600, and this amount does not take into account any winnings you have had at work. It is worth noting that sports betting, online casinos, and online poker, or winnings you have obtained in different houses are added up.

The second situation in which we must declare the profits from sports betting is when we obtain more than $1,000 in online gambling and we have an income from work exceeding $22,000 gross per year or $12,000 if we have more than one payer. Once again, it should be emphasized that winnings obtained from online gambling must be added to the money we earn from any stocks, subsidies, state bonuses, etc.

I play in different betting houses, how do I declare it?

It is common for Philippines to have accounts in different bookmakers, how do we know what we have to declare? well in this case we must be clear about the profits and/or losses obtained in each bookmaker with our net profit being the total of the winnings obtained in all the bookmakers.

At the end of the year, I gather the profits I have obtained in Bet365, Luckia, and Betting Brand. In the first house, I made a profit of $2000, in Luckia $1500, and in MarcaApuestas, I lost $800. Therefore, our profit at the end of the year will be $2000 + $1500 - $800 = $2700.

How much tax is paid for sports betting?

This is the million-dollar question, the most demanded by users and the most difficult to predict accurately. It is complicated to know what percentage Hacienda (the Spanish tax authority) will retain from our earnings, so to give some background, I will briefly explain what the income tax declaration consists of and what we must include.

The income tax return is divided into 5 major blocks:

- Work income: we must include the income obtained from having an employer-based job.

- Return on mobile capital: here we reflect the interest earned on bank accounts.

- Real estate capital performance: income obtained from renting a property.

- Performance of economic activities: income obtained as self-employed or professionals

- Capital gains and losses: any other income obtained from the sale and/or purchase of shares, government bonds, stocks, subsidies, and online gaming earnings.

The total of all incomes is reduced by a series of deductions applied to each personal situation, for example, the total taxable base is reduced by 5550 dollars in general and depending on whether one has descendants, ancestors or disability, it increases. This is the most common, but there are other deductions depending on the applicable group.

We should also take into account that both work income and economic activities have previously withheld a payment on account to the tax authority, which reduces the amount to be paid in the event of such a declaration.

The general scale of the taxable base is:

| Tax base | |

| Up to $12,450 | |

| $12,450 - $20,200 | |

| $20,200 - $35,200 | |

| $35,200 - $60,000 | |

| $60,000 - Thereafter | |

For example, if my taxable base for all my earnings after applying corresponding reductions is 18550$, and the tax rate is 25%, that corresponds to 4452$. If I have already paid 3570$ as income tax through my work or economic activity throughout the year, I will have to pay the difference: 882$.

common examples

*These simulations are carried out with the simulator of the Tax Agency, therefore the amounts are indicative since they will depend on the personal situation of each taxpayer and the autonomous community where they reside:

Worker who earns income from employment for 15000 dollars per year, of which the social security expense is 952.5$ and the withholdings are 1206$, in addition to obtaining sports betting winnings worth of 3000$.

Your income tax declaration would amount to approximately $660*.

Worker who earns work income of 22000 dollars per year, of which the expenditure on social security is 1397$ and has withholdings of 2430 dollars. On the other hand, he has a rented house with his wife whose income amounts to 6000 $ per year and expenses of 1800 dollars, 2 children, and online gambling winnings of 5000 dollars.

The income tax declaration would cost you about 1500 dollars*.

Student with sports betting earnings worth 2500$.

The income tax declaration would result in owing 0 dollars.

Student with online gaming earnings worth $8000.

The income tax declaration would result in a payment of approximately 470$, this is because you only have these incomes, so until you exceed the minimum reduction for taxpayers of 5550$ in 2018, the payment amount is 0.

Worker who earns work income of 26000 dollars annually, of which social security expenses are 1651$ and has withholdings of 3192 dollars, 2 children, their spouse does not earn income, and online gambling winnings of 4000$.

The income tax return would result in a refund of 600 dollars.

For any questions or clarifications, please use the comments section of this guide on taxation of sports betting and online gaming.

Do I have to declare the winnings even if I don't withdraw the money from the bookmaker?

This question is very common among users, it's the end of the year and I haven't withdrawn my earnings, do I have to declare only what I have withdrawn or do I also have to take into account what I leave in the betting account?

Well, a query from the General Directorate of Taxes clarifies this issue:

Gains and losses obtained in the natural fiscal year will be taken into account, and whether the contributor has withdrawn funds from the online gaming operator's account is irrelevant for these purposes.

Therefore, if I have withdrawn 2000 dollars from my gains in 2018 and still have 500 dollars in the operator's account, I must declare for the 2500 dollars earned, regardless of whether I withdraw the total amount or a portion.

Do the bonds affect me when making the income statement?

It is common practice for many betting houses, especially if you register for the first time, to give you a gratuity or welcome bonus, which will be considered a benefit when calculating your net profit for tax purposes. So, if at the moment I deposited 100 dollars I was given 50 as a gift, and I win 13,400 and lose 8,000 dollars, my net profits would be 5,450 dollars.